RIZE Investment Strategy

Welcome to the heart of our operation – the Strategy Page. This is where you’ll gain insight into the core principles and methodologies that drive RIZE Equity’s success. We believe that understanding our approach is a crucial part of your investment journey. That’s why we’ve broken down our strategy into three essential components: our Investment Criteria, Investment Process, and Target Markets.

Our Investment Criteria

In our selected markets, we actively pursue the acquisition of Class A, B, and C properties, specifically those ranging from 50-300 units. However, we don’t just take opportunities at face value. Each potential deal undergoes a meticulous evaluation process to ensure it aligns with our expected return criteria. In our examination of prospective investments, we prioritize the following key factors:

- Employment Opportunities

- Proximity to Major Cities

- Market Supply and Demand

- Dynamics

- Safety Measures

- Accessibility and Transportation Infrastructure

With these crucial parameters in place, we ensure that each investment opportunity is well-poised to deliver robust returns and long-term value.

Jobs

City Proximity

Supply/Demand Profile

Safety

Transportation

Our Investment Process

STEP 1

Acquisition

We relentlessly pursue opportunities through three channels:

- Strong broker relationships

- Direct to seller mailing campaigns

- Technology such as Reonomy and COSTAR

We may screen 100 deals before choosing one.

STEP 2

Underwriting

Sound underwriting principles are a key component of our risk management program and we employ the following practices to protect our investor’s capital:

- Conservative projections for rent growth, vacancy and capital expenditures

- Pro forma projections are based on historical data, not speculative numbers

- Properties are capitalized with adequate cash reserves

- If a deal meets our stringent underwriting criteria, we move to place it under contract.

STEP 3

Contract

The contract phase demands rigorous attention to detail to ensure that the deal structure maximizes the return potential for our investors and we employ a team of highly vetted real estate lawyers to review all contracts prior to signing.

STEP 4

Due Diligence

Purchase contracts are conditioned upon a meticulous due diligence inspection. Highlights include:

- Audit and verification of seller financial statements

- Third party inspectors for major structural components

- Individual unit inspections with photo and video documentation

- If the property passes the due diligence inspection, we proceed to closing.

STEP 5

Closing

The days leading up to closing can be chaotic. To ensure we don’t miss a step, we employ:

- A 180 point closing checklist and will not consummate the transaction until complete.

- Consistent communication between all parties to the transaction

- Final walkthrough prior to closing

After closing, we shift into the post-closing/asset management phase of the transaction.

STEP 6

Asset Management

Although we hire a professional property manager, we remain actively involved in the following:

- Daily communication with property management

- Quarterly audits of rent and collection reports, investor updates and distributions

- Preparation and distribution of required tax documentation

- To facilitate these activities, we utilize state of the art investor management software

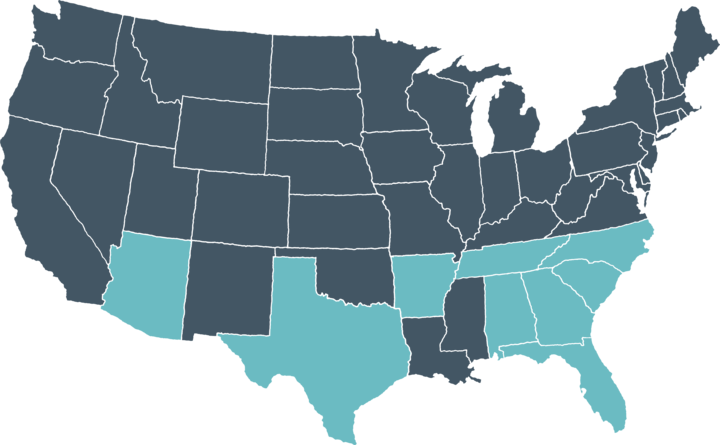

Our Target Markets

Ensuring our target markets align with our investment criteria involves thorough market trend analysis and economic indicator review. We examine factors like job opportunities, supply-demand dynamics, proximity to major cities, and local infrastructure.

Through this concise evaluation, we aim to ensure our chosen markets are primed to meet our investment standards and deliver substantial returns. At RIZE Equity, your investment is a strategic step towards financial success.

RIZE to The Challenge

A Passive Investor’s Guide to Multifamily Investment.

Read this overview and learn about:

- How our company paves the way for your journey to Financial Independence. Align yourself with a team of seasoned real estate investment professionals committed to supporting you at every juncture.

- Supercharge your wealth creation with the commercial real estate asset class that offers an optimal risk-adjusted return.

- Identify, Assess, and Secure profitable multifamily apartment projects situated in some of the United States’ most robust markets.

Dive into this comprehensive guide and kickstart your journey towards robust financial growth with RIZE Equity.

Complete this form to receive your Passive Investor Guide.

1. Lead Magnet - RIZE To The Challenge

"*" indicates required fields

Embark on Your Journey Today!

Tap into the wealth and income-generating power of multifamily apartment investments as a passive investor. Your first step? Click the link below. By scheduling a call with our expert team, you’re not just making an appointment – you’re initiating a journey towards significant financial growth. Are you ready to unlock these opportunities? Schedule your call today.